Central Bank Resumes Bill Issue Channel to Net Withdraw Money

|

| SBV’s headquarters in Hanoi. Photo SBV |

The State Bank of Vietnam (SBV) has used the bill issue channel again to net withdraw money out of the banking system for the first time since June 2020.

Previously, the SBV ceased the bill issue to keep the banking system’s liquidity surplus so as to actively help interest rates stay at very low levels to support the economy amid the COVID-19 pandemic.

Accordingly, in the trading session on June 21, the SBV sold VND 200 billion of seven-day bills at an interest rate of 0.3% per year, equivalent to a net withdrawal of VND 200 billion out of the market.

According to Tran Ngoc Bau, founder and CEO of data provider WiGroup, when the banking system has a surplus of money, interbank interest rates will drop sharply. If it falls to the floor rate set by the SBV, the SBV will issue bills to withdraw cash to reduce the surplus of money in the banking system, which will help interbank interest rates to increase again to the SBV’s target level.

The SBV has actively bought US dollars since 2018 when Vietnam had a record balance surplus. It meant a correspondingly huge amount of Vietnamese Dongwas pumped into the economy during the period.

Before June 2020, the SBV actively issued bills to gradually withdraw the cash out of the banking system. However, to deal with the economic crisis due to the outbreak of the pandemic, the SBV decided to cease the bill issue channel from June 2020 to maintain a liquidity surplus for the banking system so as to make interbank interest rates stay at a very low level for nearly a year.

Since the beginning of May, the liquidity of the banking system has continuously remained abundant, which has caused a reduction in lending interest rates in the interbank market. The rate is currently falling to the lowest level since April 2021.

The SBV’s data showed the average interbank interest rate for overnight Dong loans on June 20 was 0.38% per year, down more than 3 percentage points compared to the highest level recorded on February 10. The rate for one-week loans also decreased by 2.21 percentage points to 1.09 per cent per year.

According to analysts, many commercial banks have used up all assigned credit quotas so they cannot lend since the last days of May, causing an excess of cash and an interest rate reduction on the interbank market.

Under the current regulations, the SBV sets credit growth limits for each commercial bank at the beginning of the year depending on the bank’s health, including capital adequacy ratio, financial strength, risk governance and operational status. This was done to control credit growth of the entire banking system and to ensure money supply and inflation control as targeted by the Government.

According to the SBV, credit of the Vietnamese banking system as of June 9 surged by 17.09 % against the same period last year.

SBV Deputy Governor Dao Minh Tu said the surge showed the economy had positive signs and the daily life, production and business of people and firms had also returned to normal thanks to the Government's effective measures against the pandemic.

The credit growth target of the entire banking system in 2022 that the SBV set at the beginning of this year was 14% However, the SBV said the target could be adjusted up or down at the end of the year, depending on the actual situation, to ensure it meets targets of macro-monetary policies and inflation control.

| Central bank’s proposed clampdown on cash loans might hurt finance companies With the government seeking to clamp down on cash loans given by finance companies, there are fears their bottom lines might be hit. |

| Vietnam named Ms. Nguyen Thi Hong as first female central bank governor Vietnam’s National Assembly on Thursday approved the appointment of a female candidate for the post of governor of the country’s central bank. |

| Vietnam’s Central Bank Continues to Improve Exchange Rate Flexibility to Ease US Currency Concern The State Bank of Vietnam (SBV) will continue to improve exchange rate flexibility over time. |

Recommended

National

National

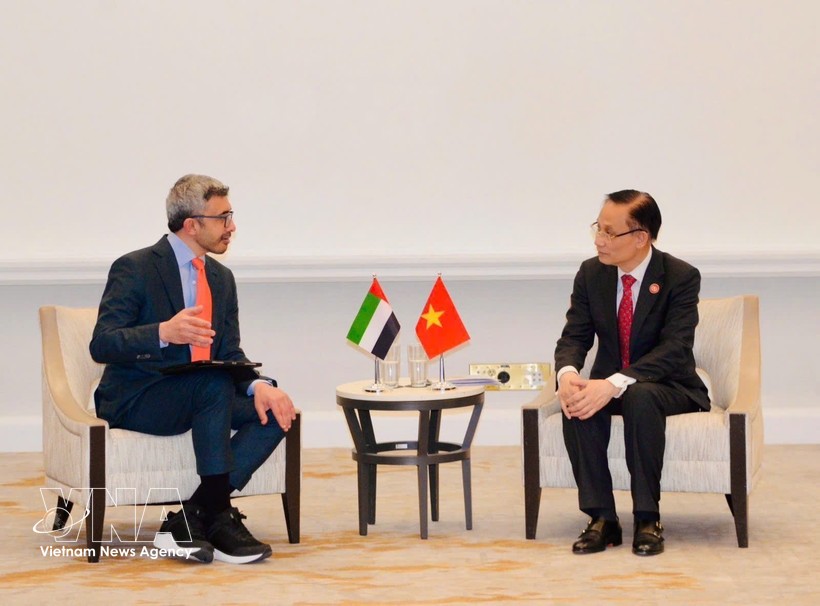

Vietnam News Today (Feb. 22): Vietnamese FM Meets Counterparts of UAE, Egypt and Türkiye

National

National

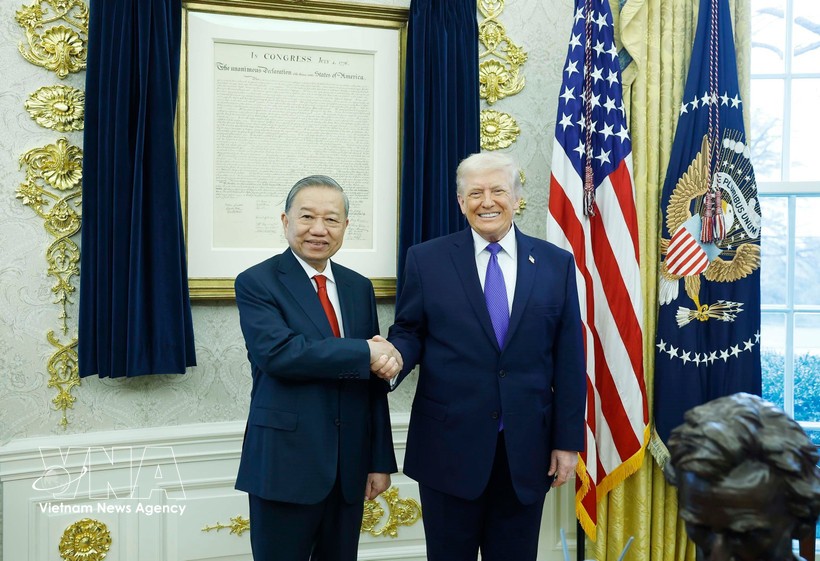

Party Chief’s US Trip Marks Milestone in High-level Multilateral Diplomacy: FM

National

National

Party General Secretary To Lam Meets US President Donald Trump at White House

National

National

Vietnam News Today (Feb. 21): Vietnam, US Step Up Dialogue to Facilitate Trade Ties

National

National

Party General Secretary To Lam Attends Inaugural Meeting of Gaza Board of Peace in US

National

National

Vietnam Promotes Multilateral Dialogue on Nuclear Non-proliferation Ahead of the 2026 NPT Review Conference

National

National

Vietnam News Today (Feb. 19): Vietnamese in France Cherish Traditional Practices During Tet

National

National