Laborers Benefit from the Amended Social Insurance Policy

The Vietnamese Ministry of Labor, War Invalids and Social Affairs is collecting people's opinions on the draft Law on Social Insurance (amended), which proposes to reduce the year of social insurance contributions from 20 to 15 years to enjoy a minimum pension of 45%.

Nguyen Duy Cuong, Deputy Director of the Social Insurance Department of the Ministry of Labor, Invalids and Social Affairs said to the media that this regulation is intended to create opportunities for late participants, who are already 45-47 years old when starting the contribution. This is also beneficial to employees who participate intermittently and do not accumulate enough 20 years of social insurance contributions at the time of retirement.

These cases will now receive a monthly pension while would not previously be entitled to a pension according to the Social Insurance Law 2014. However, as regulated in the Law, employees participating in social insurance for 15 years will receive a low pension. For example, many businesses are contributing to social insurance for employees only slightly higher than the regional minimum wage, fluctuating VND 5 million, then the minimum pension is only 45% of the average payment during the process, which is only about VND 2 million.

|

| The proposal to reduce the year of paying social insurance contributions is one of the solutions to ensure an increase in the number of people staying in the social insurance system to enjoy their pensions. (Photo: Thoi Dai) |

"For people who pay social insurance for 15 years, the pension may be low, but it is still better than none. In addition, they are also entitled to free health insurance card", said Cuong. He also added that pensions are adjusted annually by the Government based on the increase in the consumer price index and the ability to balance the budget.

The draft Law on Social Insurance (amended) also adds regulations on calculating the pension rate for those who have paid social insurance contributions for less than 20 years in accordance with the amendments to the conditions for pension enjoyment and the signing and participation in the provisions of the international treaties.

Statistics of the Vietnamese Ministry of Labor, War Invalids and Social Affairs show that there are currently about 20,000 people reaching retirement age but not meeting the number of years of contributions that have chosen to make a lump-sum contribution to enjoy pension. Meanwhile, about 300,000 people who have contributed for 10 years or more until retirement age are not eligible for pension.

| Efforts made to observe rights of foreign workers’ social insurance Bilateral agreements for a new generation of social insurance policy have been negotiated to support foreign workers engaging in Vietnam’s social insurance scheme, said Deputy ... |

| About 62,000 foreign labourers join compulsory social insurance in Vietnam After 10 months since compulsory social insurance collection applied, as many as 62,000 foreign labourers have joined social insurance in Vietnam. |

| Social Insurance Policies Ensure Social Security Amid Pandemic Since the outbreak of Covid-19 pandemic, the Government has offered timely assistance to people and businesses, especially those belonging to vulnerable groups, to help them ... |

Recommended

National

National

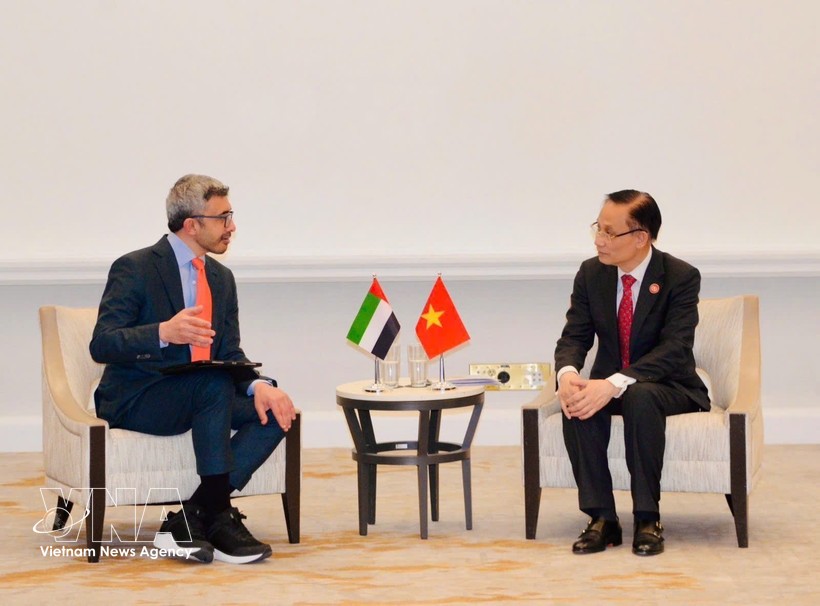

Vietnam News Today (Feb. 22): Vietnamese FM Meets Counterparts of UAE, Egypt and Türkiye

National

National

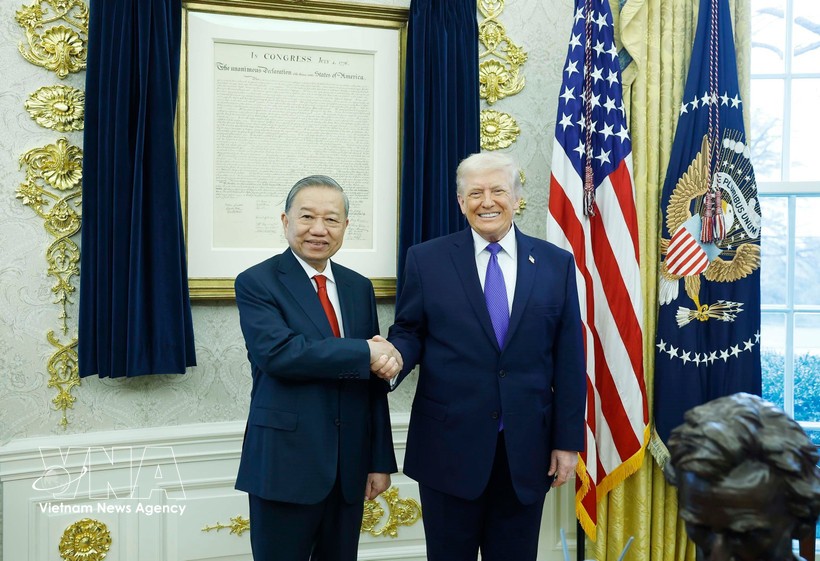

Party Chief’s US Trip Marks Milestone in High-level Multilateral Diplomacy: FM

National

National

Party General Secretary To Lam Meets US President Donald Trump at White House

National

National

Vietnam News Today (Feb. 21): Vietnam, US Step Up Dialogue to Facilitate Trade Ties

National

National

Party General Secretary To Lam Attends Inaugural Meeting of Gaza Board of Peace in US

National

National

Vietnam Promotes Multilateral Dialogue on Nuclear Non-proliferation Ahead of the 2026 NPT Review Conference

National

National

Vietnam News Today (Feb. 19): Vietnamese in France Cherish Traditional Practices During Tet

National

National